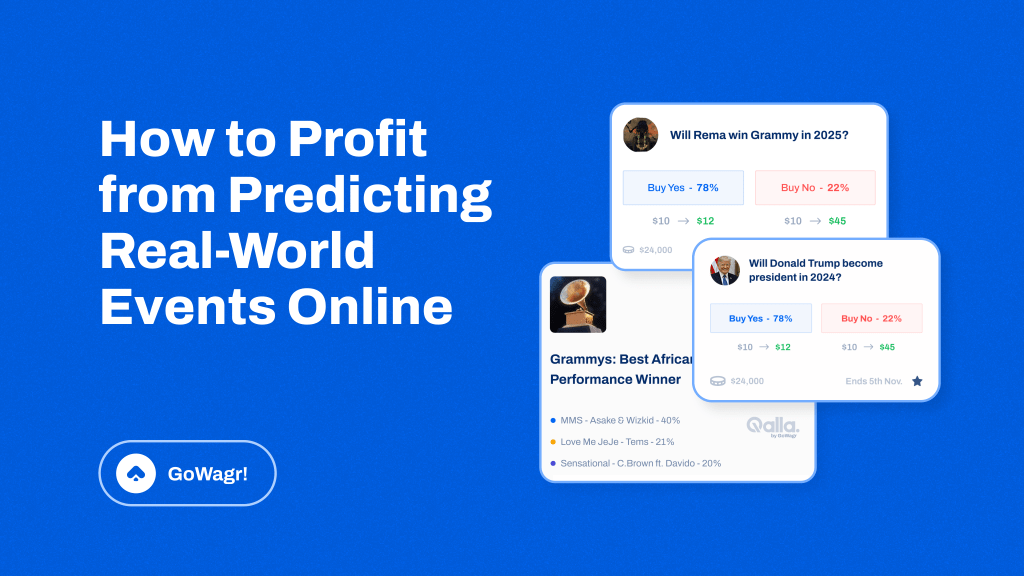

Imagine turning your knowledge of current events, politics, sports, or pop culture into real money. With prediction markets, you can do just that.

You can profit by trading shares on real-world outcomes in sports, politics, entertainment, finance, technology, and more! Whether it’s an election, a major sports final, or a trending event, knowing how to profit from predictions can give you an edge over others.

In this guide, we’ll break down how to profit from predictions, how prediction markets work, the best strategies to maximize your earnings, and the risks to watch out for.

What are Prediction Markets and How Do They Work?

An online prediction market is a platform where you can buy and sell shares that represent the outcome of an event. Event outcomes are represented by “yes or no.” If you believe an event will happen, buy yes shares. If you believe otherwise, you can buy no shares.

The share values fluctuate based on market sentiment or real-time updates. If your prediction is correct, you profit when the market resolves or if you sell at the right time.

Unlike traditional gambling, a prediction market operates more like a stock or crypto market but for opinions. Instead of betting against a house, users trade with each other, and the platform earns a small fee from transactions. This makes it a potentially attractive option for those looking for alternative investment opportunities.

Types of Prediction Market Strategies

Prediction markets allow for different strategies based on trading styles and risk tolerance. Here are some key strategies that successful traders use:

- Long-Term Holding vs. Short-Term Trading – Some traders prefer to buy shares early and hold onto them until the event resolves, while others sell shares before it is resolved to lock in profits. The choice depends on your risk tolerance and market conditions.

- Momentum Trading – This involves buying shares when they start gaining popularity and selling when prices peak. Traders monitor market trends, social media discussions, and breaking news to identify opportunities.

- Contrarian Trading – This strategy involves going against the crowd. If an event seems overhyped, you can buy No shares, betting that the majority is wrong. Contrarian traders often benefit when markets correct themselves.

- Hedging Strategies – Advanced traders manage risk by investing in both Yes and No shares of different but related markets. For example, if two teams are competing in a tournament, a trader might invest in different match outcomes to minimize losses.

If you understand and apply these strategies, you can significantly increase your profits and manage your risks effectively.

How Market Odds and Pricing Work

In prediction markets, the odds of both sides (yes or no) must be equal to 100%. Market odds and pricing of shares are determined by the collective sentiment of traders. The price of a share represents the implied probability of an event occurring. Here’s how it works:

- Supply and Demand – When more traders buy Yes shares, the price rises, indicating a higher probability of the event happening. In contrast, when traders sell Yes shares or buy No shares, the price drops.

- Early vs. Late Trading – Buying shares early can be cheaper, but riskier, while buying closer to the event’s resolution may be more expensive but based on more concrete information.

- Market Fluctuations – Prices shift based on breaking news, expert opinions, and social sentiment. A single event, such as an injury in sports or a government announcement, can quickly change the market.

Understanding market pricing will allow you to identify undervalued opportunities and capitalize on events that are mispriced.

How to Profit From Predicting Events Online: A Step-by-Step Guide

1. Choose Your Niche Wisely

Are you a football fanatic? A startup enthusiast? Or a political analyst? Your knowledge is your advantage. The more informed you are, the better your chances of making smart trades. To maximize profits, focus on the topic, category, or industry where you have better knowledge. Common niches include:

- Sports – You can predict match results, player performances, or league outcomes. E.g. on Qalla by GoWagr you can predict if Chelsea will finish top 4 in the EPL.

- Politics – You can trade your opinions on election outcomes, policy decisions, or government actions.

- Entertainment – You can guess award winners, album sales, celebrity milestones, or rumors. E.g. Who will win the headies next rated award?

- Technology & Startups – Predict the next unicorn startup or product launches, market trends, or company valuations. E.g. Will Moove become a unicorn in 2025?

- Finance & Crypto – Forecast stock movement or prices, cryptocurrency milestones, or economic policies. E.g. will Bitcoin reach $110,000 in February?

2. Understand Market Trends and Sentiment

Success in prediction markets depends on research and timing. Markets shift based on breaking news, expert insights, and public sentiment. Keep an eye on real-time updates to adjust your position strategically.

Stay updated with:

- News and social media trends – Major developments can shift probabilities instantly.

- Historical data – Past trends can provide insights into likely outcomes.

- Expert opinions and analysis – Following credible analysts or sources can give you an edge.

3. Buy Shares Based on Your Belief

Every market has two outcomes: “Yes or No.” Each side represents the likelihood of an event occurring. Market prices fluctuate based on demand and market sentiment. For example:

- Flutterwave has been hinting at going public for a while. If you think they will IPO in 2025, you can buy yes shares, if not, you buy no shares.

- If the market overestimates an outcome, buying No shares can be equally profitable.

4. Sell at the Right Time

Profiting isn’t just about making the correct prediction, it’s also about knowing when to sell. You can sell your shares before the event concludes if you believe their value has peaked. This strategy helps lock in profits and minimize risk.

Learn more about How to get Started with Qalla by Gowagr and trade your opinion on any event!

How to Manage Risk in a Prediction Market

Like every other financial endeavor, there are risks. But your ability to manage them keeps your risk level low. Here are common ways to manage risks in a prediction market;

- Start with small trades: Learn the system before making larger investments.

- Diversify your markets: Not sure about an outcome? Spread your investments across multiple related markets to balance risk. For instance, in a sports event, you could invest in different player performance or league predictions to optimize returns.

- Leverage social sentiment: Engage in market discussions to gauge sentiment shifts.

- Stay updated: News updates can significantly impact predictions. Understanding how to analyze data for profitable event predictions is also crucial.

- Develop a risk management plan: Determine how much you’re willing to lose and stick to it.

Why Choose GoWagr for Event Outcome Trading?

Qalla by GoWagr is one of the best online prediction platforms. It offers a dynamic and fair marketplace where you can leverage your knowledge to trade and get returns on your invested cash. Here’s why Qalla stands out:

- Trade with Market Participants: No house advantage; you are trading against other users.

- Multiple Markets – From sports and finance to politics, entertainment, and tech, there’s always something to predict.

- Early Profit Opportunities – If you buy shares early, you can yield significant profits as market trends shift.

- Low Transaction Fees – Unlike other platforms, Qalla only gets a small transaction fee.

Are Prediction Markets Profitable?

The answer is yes, with the right approach. While there are inherent risks, how much profit you get in a prediction market depends on your skill, strategy, and risk tolerance. By following the tips and strategies outlined in this guide, you can increase your chances of success. Sign up on GoWagr today and start trading on Qalla!

Your Next Steps: Getting Started With Qalla by GoWagr!

Ready to trade your opinion and make a profit if you’re right? Follow these steps to get started on Qalla.

- Download the GoWagr app on App Store or Play Store and sign up or log in.

- Deposit funds in your wallet using your local currency (Nigerian Naira) or in cryptocurrency (USDT) (See how to fund your Gowagr wallet with USDT)

- Explore the available markets.

- Pick a side and buy either “yes or no” shares.

- Get returns on your cash when the market resolves and easily withdraw your profits.