Financial experts say the stock market is one of the best ways to build long-term wealth. Investing in big companies like Apple, a billion-dollar company, can be a smart move. When you buy Apple shares, you essentially own a piece of Apple.

But anything can affect your investment. Bad PR, a workplace issue, or even new government rules can cause the share price to drop, which affects your profit.

Prediction markets, on the other hand, work differently. You’re not investing in companies, you’re trading based on what you know or expect to happen. If something changes, like breaking news, a policy shift, or even an unexpected event, you can immediately decide if it’ll affect the outcome and sell your shares if needed.

At first, both markets may look similar, prices go up and down, people make money or lose money, and information is key. But when you take a closer look, the differences are clear.

In this stock markets vs prediction markets post, we’ll break down the main similarities and differences between the stock market and prediction markets. Let’s get started!

What is the Stock Market?

The stock market is where investors buy and sell shares of publicly traded companies. When you buy stock, you own a small part of that company. Your shares can go up or down in value depending on how the company performs and the general market behaviour.

These trades happen on big exchanges like the New York Stock Exchange (NYSE) and NASDAQ. You can also trade other financial instruments like ETFs and options if you want to try more advanced strategies.

Trading stocks usually requires some understanding of financial analysis, market trends, and risk management. Still, it’s considered one of the most proven ways to build wealth over time.

What are Prediction Markets?

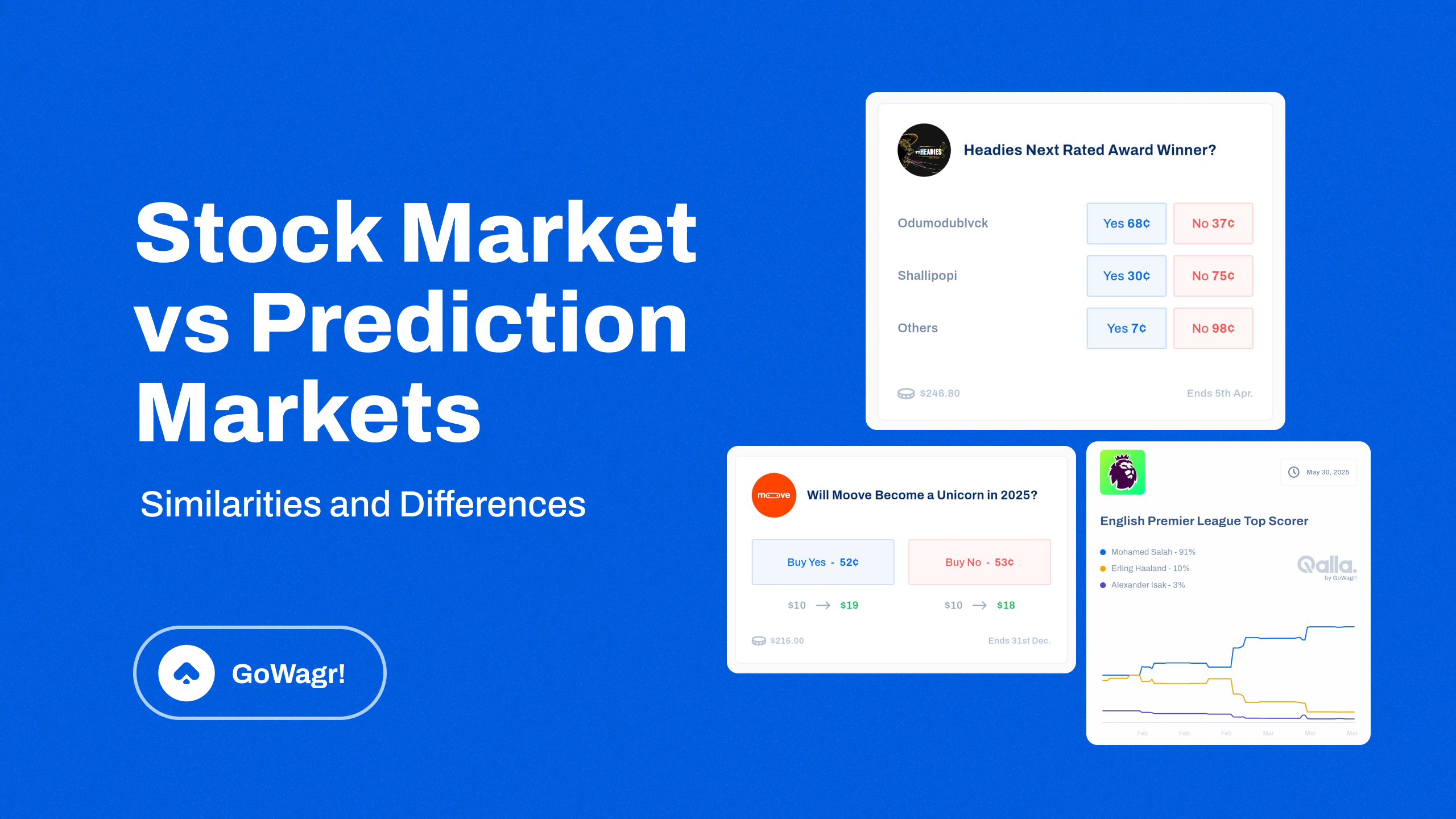

Prediction markets are platforms where users trade the outcomes of future events. These events could range from elections to sports, technology news, music, entertainment, and so much more.

Here’s how it works: you predict whether something will happen or not. Like, will Bitcoin rise to $150,000 in 2025? Yes or No.

Event outcomes are represented by “yes” or “no”, meaning you can only pick one of these as the outcome of an event, not both. Like the stock market, the prices of these shares depend on market activity and how confident people are in a particular outcome.

A great example is Qalla by GoWagr. On Qalla, you can predict the outcome of various events, buy shares based on what you think will happen, and receive payouts if you’re correct.

Key Similarities and Differences: Stock Markets vs Prediction Markets

Similarities

- Market-Driven: Both rely on supply and demand. Prices reflect what traders collectively believe.

- Opportunity to Profit: You can earn money based on your analysis and timing.

- Volatility and Risk: Both involve risk, and traders can gain or lose money based on outcomes.

- Information Matters: Having the right info or insight gives you an edge in both markets.

Differences

| Feature | Stock market | Prediction market |

| Underlying asset (what you are trading) | Shares of companies represent ownership and earnings | Outcomes of real-world events |

| Regulation | Highly regulated by financial authorities (e.g., SEC) | Lightly regulated |

| Share prices | Based on financial data, company performance | Prices reflect probabilities (e.g., 0.72¢ implies 72% chance of an outcome) |

| Accessibility | Requires a brokerage account, often tied to a minimum investment | Just download the GoWagr app to start |

| Profit | Based on company performance and dividends | $1 payout per correct share. If you buy at 0.30 cents per share, you earn $1 per share if you’re correct.That’s over 3x return |

| Market drivers | Corporate earnings, economic data, investor sentiment, and geopolitical events | News, real-world developments, insider knowledge, random real-world changes |

Example Comparison:

- In the stock market, you might invest in Apple or Google, hoping their business does well and your shares grow in value. Your returns depend on how the company performs over time.

- In a prediction market, you could buy shares predicting that Bitcoin will hit $150K or that a football team will win a final. If your prediction is right, you receive a payout.

Core Difference: Stock markets are about owning valuable assets and growing wealth over time. Prediction markets are about information trading. You profit not by holding, but by being right.

For example, if you believe a certain presidential candidate will win the election, you can buy “Yes” shares. If they win, you earn. In the stock market, you can’t make that kind of direct call.

Learn More: Betting vs. Prediction Markets: Key Differences and Similarities

Stock Markets vs Prediction Markets: Pros and Cons

Pros:

| Stock Market | Prediction Market |

| Stocks have historically delivered solid long-term returns. | Easy to start, no financial background needed |

| Tools, analytics, and protections are readily available to help you. | You can trade on everything from GDP reports to Grammy winners. |

| Easy to enter and exit trades on major exchanges. | Traders can profit from specialized information others might overlook. |

Cons:

| Stock Market | Prediction Market |

| Trading profitably demands time, knowledge, and experience | Lower liquidity. Some markets may have fewer participants, affecting trade execution. |

| Events outside your control (e.g., geopolitical tension) can affect performance. | If the event is canceled or unclear, markets may be voided. |

| You’re up against institutional investors and advanced algorithms. |

Which One is Better for Trading?

There isn’t a one-size-fits-all answer. It depends on what kind of trader you are.

- Long-Term Investors: The stock market is better for building wealth over time. If you’re interested in dividends, company growth, and economic cycles, traditional equities are still king.

- Short-Term Opportunists: Prediction markets shine for quick, information-driven trades. They allow you to act on real-world news and niche knowledge before the broader public catches on.

- Risk Tolerance: Prediction markets offer clearer outcomes (win or lose), which can be easier to manage than the rollercoaster of stock prices. But they also come with the risk of losses if your prediction is wrong.

- Capital Requirements: With platforms like Qalla, you can get started with minimal capital, like $1. Stock markets may require more funds to generate meaningful returns.

In truth, many traders are beginning to use both. They invest long-term in stocks and use prediction markets to trade short-term trends and sentiment.

Recommendation

Both the stock market and prediction markets offer unique benefits. The stock market provides depth, scale, and long-term potential. Prediction markets offer speed, diversity, and accessibility.

If you’re just starting or enjoy trading around current events, prediction markets like Qalla by GoWagr are a great entry point. For those with more capital and long-term goals, the stock market remains a reliable option. The best traders may find an edge by combining both markets.

Ready to Explore Prediction Markets?

Platforms like Qalla by GoWagr make it easy to start trading on real-world outcomes. Whether you’re confident about a political race, a crypto trend, or an economic report, there’s a market for you.

Download the GoWagr app and see how your knowledge can help you get returns on your investment!